For every adventurous person, travelling can be the best experience indeed. Preparing your luggage and having thorough research on places that you are going to visit makes it even more exciting than ever. However, it is also very important for every backpacker to consider that there are several risks associated with travelling, and it must never be neglected at all times. Every step you make during your trip could ruin the whole experience, and without proper guidance, you might find it quite difficult to avoid.

One of the risks that you should be aware of are those that could threaten your safety. Reme

mber that you will be away from the comfort of your home, and you are about to witness cultures that are pretty much foreign to you. So, it might be the best option to invest in something that could save you from a lot of trouble just in case something bad happens. And this could come in the form of travel insurance.

It may seem like a no brainer for some but contrary to popular belief, the concept of travel insurance has been around for over a thousand years. The earliest known record of insurance policies involving travel can be traced back to ancient Mesopotamia where merchants would pay operators of caravans to keep their goods from getting stolen or damaged. This service could be compared to one of the benefits of travel insurance today which covers the issues regarding luggage. Hundreds of years have passed and in 1750 BCE, the first insurance for maritime services was created. This type of insurance covers the loss of hull as well as granting protection for lost cargos.

Finally in April 1864, an American named James Batterson founded the world’s very first and legitimate travel insurance company in the world. It was named the Traveler’s Insurance Company. The company’s aim was to provide the insurance solely for travelers against theft and unexpected accidents. Other companies offering the same services started to emerge and since then the travel insurance industry has gained its foothold in the world of business.

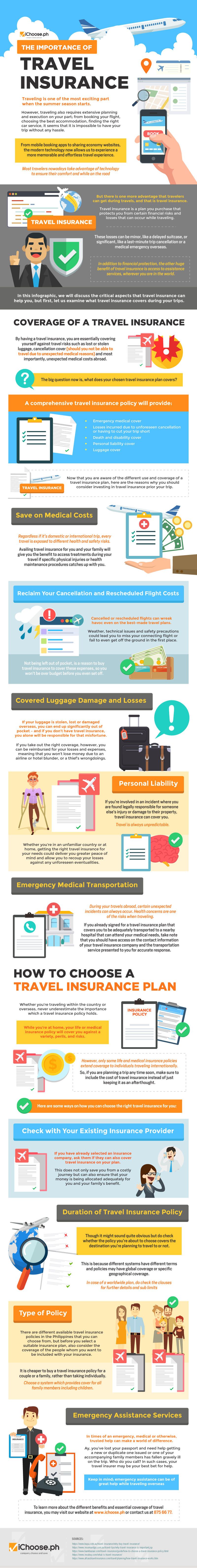

Most people tend to neglect the benefits of travel insurance until it’s too late. What they should realize earlier on is that affording travel insurance means that they are essentially covered from certain financial risks and losses that can potentially occur while travelling. These could range from lost or stolen luggage, cancellation cover, and of course, unexpected medical costs abroad. And speaking about medical expenses, we all know how costly they can be on your home country. Just imagine paying those bills on foreign currency!

Most travel insurance policies can also cover the following:

- Personal liability cover

- Death and disability cover

Here’s some travel insurance trivia. According to betravelwise.com, statistics show that of the people who afforded travel insurance, only 3% of them have made claims. 56% of these claims are for medical expenses, 34% for cancellations, 5% for baggage and money, and another 5% for reasons unknown. But don’t let these numbers discourage you from taking travel insurance. Remember that prevention is always the best cure!

Additionally, when choosing the safest way to travel, an air trip is by far the least dangerous ones. Combined with travel insurance, rest assured that your experience will be much fun and safer.

Now that you know what’s the use of travel insurance, it’s time to give you tips on choosing the most appropriate travel insurance for you:

Tip #1: Be sure to check your existing insurance provider – In the event that you already have an insurance company, try asking them if they also can add travel insurance on your already existing plan.

Tip #2: Know the duration of your travel insurance policy – Insurance policies can vary from company to company, and it includes the duration of your plan’s coverage. Check whether the policy covers the destination you’re planning to travel or not.

Tip #3: Know the types of policy – There are many types of insurance policy available and make sure that you choose one that can cover all of your family members, including the children.

If you wanted to learn more about the importance of affording yourself and your family travel insurance, you should check out this infographic below brought to you by iChoose.ph:

This is a bit off about Admin. Admin is a Best and Professional Blog Writter, Social Media and Content writing regards various niches like lifestyle, entertainment, education,technology and many etc, Admin is SEO Analysis of Marketing Profs. That`s enough for more details please so him at social media or go to contact us page.