What are the Main Steps to Project Financial Management?

Just a good idea alone is not adequate to form a thriving business project or enterprise. It needs much more than that. You have to identify from where to procure the necessary financial as well as technological resources, and alongside, you have to search for the righteous human resources with apt skills and abilities to execute the job. If you know where to seek for these resources, you can save your valuable time and money, and can also gain some worthwhile partners in this procedure.

There are various new business projects or startups that have nowadays, some of which are doing exceptionally well than the rest ones. What thing makes such ventures different from the rest of the businesses? It is a crucial component of acquiring and managing resources. Here comes the concept of Project Financial Management.

The Project Financial Management is the process that collectively involves project planning, budgeting, accounting, financial reporting, auditing, internal control, procurement, disbursement, along with the physical performance of a project with the main objective of management of project resources efficiently to achieve the goals of the project.

So, lets discuss the major steps of project financial management.

1. Identification of Project

It is not that challenging to identify competent projects in requirements of investments and other assistance needs. Even so, if you are starting from the grass-root level and have no idea of this, there are various consultancies and funding institutions that will provide you assistance for pursuing your venture. There is various project financial management software available, which will further facilitate your operations.

At this step, on the identification of the project, to initiate the project development process, you must link up with and devise strategies with your potential partners, if any.

2. Determining the Project Feasibility

After identifying a promising project, now your next and most critical step should be determining the feasibility or potentiality of establishing the venture. This step demands to devise a master plan with all the minute details, that portrays the understanding of the venture partners’ regarding:

- The markets selected for the sale of your products, considering industry trends, tariffs, and non-tariff barriers, etc.

- Level of domestic and international competition in your selected industry.

- The costs of technology, human resources, and other necessary resources and equipment for your project.

- The sources of capital and the approximate profit that the project can make. Also, you should consider repayment strategies for any borrowed funds acquired.

- Your competitive edge over other players in the market. You should be capable of delivering quality products at a reasonable price.

With the feasibility studies, you can approach a financial institution to seek funds for your venture. If your venture found to be feasible in most aspects, your project can get approval from investors.

You may also like to read:- Why You Should Hire a Business Plan Consultant

3. Identification of Technology Sources

Your next step should be acquiring the required equipment for your project and the individuals with appropriate skills to manage the project operations involving the manufacturing process. One of the quick ways to determine the equipment required is to contact any national industry association and ask them to put in the touch of a company that is in the same business or is engaged in the production of similar products that you want to make. Several publications are listing various industry associations and their contact details available at most public libraries.

Once you develop an outline of what technical know-how and equipment you require for your project, the next work is on how to acquire these things. You can acquire machinery and equipment by taking them on a lease, but you should ideally purchase them as you would need them for the long-term. Industry associations prove to be good sources of information on suppliers of new as well as used equipment.

4. Identify Sources of Finance

The funds employed in a business or capital is bifurcated as owner’s funds and borrowed funds. Few people afford the entire cost of the project on their own. But usually, the owner’s funds are not enough to launch a new venture. Hence, the remaining quantum of funds is needed to be acquired externally. There are a lot of banks and financial institutions that provide loans for business ventures. You can also approach to venture finance institutions or find angel investors to acquire funds for your project.

5. Moderating the Project Risk

Despite the supreme intentions and proper planning, uncertain events or contingencies can occur any time, which can hamper your project. There could be risks related to different aspects of the business environment, such as changes in the national government or taxation policy of the country, devaluation of the currency, labor controversy, etc. You should opt for insurance against possible risks or uncertainties.

Ideally, to keep pace with the advancing environment and operate efficiently, you can also make use of project management software or a financial tracking software.

Some project management software comes with integrated financial tracking software. project management software is a software designed for planning, organizing, and managing projects. It helps in planning, organizing schedules, allocating resources, managing risks and other issues, co-ordinate communications, and helps to monitor the progress of the project.

For the financial aspect of your business, you can use a project financial management software or financial tracking software. It is a system or software that you can use to track and control the income, expenditure, and assets to maximize the revenues and assure the sustainability of the project. An effective Financial tracking software enhances the short-term and long-term performance of a business by aligning all financial elements.

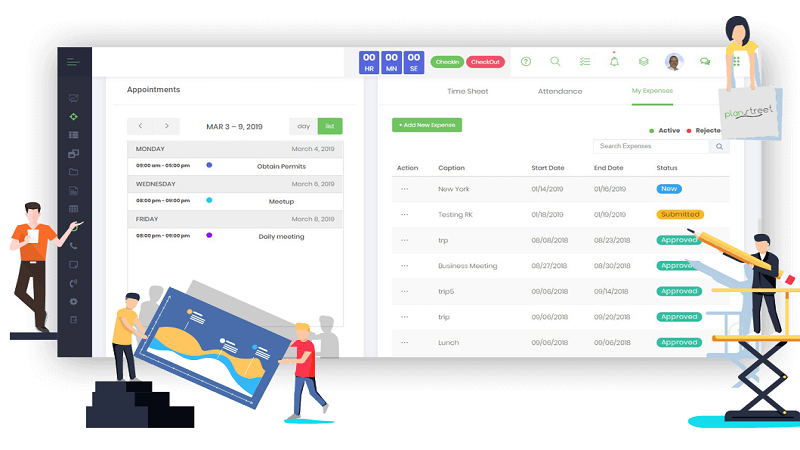

There are various project financial management software with distinctive features that are available in the market. For example, an outstanding Project financial management software which you can use is Plan Street. Plant Street ensures cost optimization and delivers the project within specified budgetary limits. Its comprehensive project financial management tools are highly useful for project budgeting and forecasting. It provides you everything from a broad view to every minute detail of various costs involved. All your costs and expenses are accounted for under its financial management with utmost transparency.

Its main features involve project portfolio, labor cost forecasting, Real-time financial tracking, Employee task management module, and much more.